Launching a Portfolio Acceleration Platform at a Venture Capital or Private Equity Fund

David Teten

APRIL 1, 2021

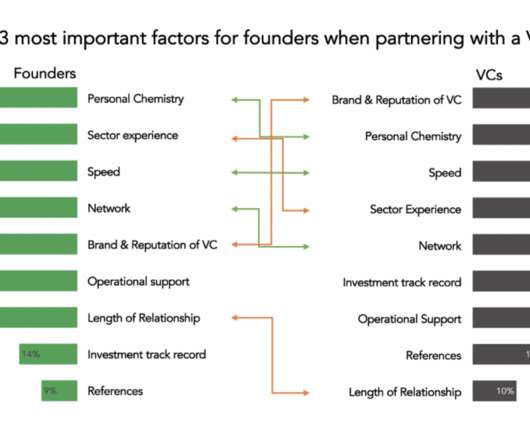

I’ve recently advised a number of emerging private equity and VC funds who are wrestling with the question: What are the highest impact steps they can take to support their portfolio companies? . Almost every private equity and venture capital investor now advertises that they have a platform to support their portfolio companies.

Let's personalize your content