What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

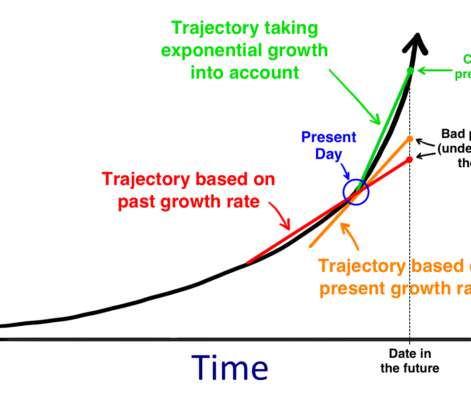

At our mid-year offsite our partnership at Upfront Ventures was discussing what the future of venture capital and the startup ecosystem looked like. We drew this conclusion after a meeting we had with Morgan Stanley where they showed us historical 15 & 20 year valuation trends and we all discussed what we thought this meant.

Let's personalize your content