In Defense of the IPO, and How to Improve It

Ben's Blog

AUGUST 28, 2020

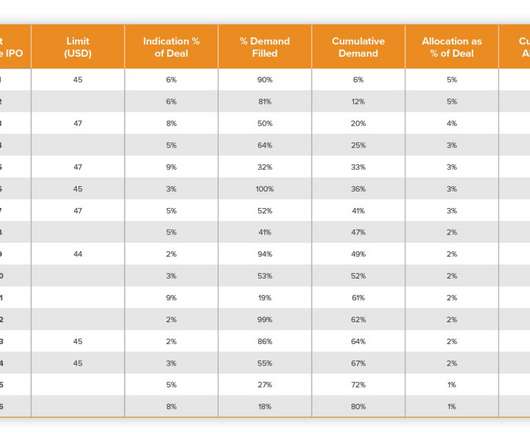

There’s a popular narrative that evil investment bankers are intentionally underpricing traditional IPOs to steal from companies, lining banker pockets and those of their fatcat Wall Street clients. The proof is seemingly obvious: IPOs are 50x oversubscribed!

Let's personalize your content