Dan Lok Explains Venture Capital Funding and How to Secure It

The Startup Magazine

SEPTEMBER 15, 2020

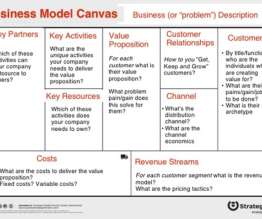

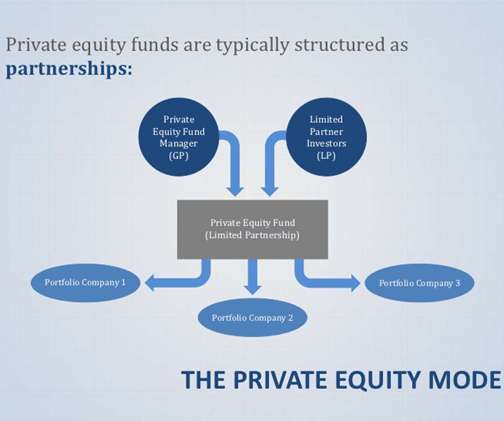

Dan Lok explains what venture capital funding is and how to secure it for your business. It is a type of financing that investors can provide to startups and small businesses which are believed to have the potential for success in the long term. Your pitch deck provides an overview of your entire business.

Let's personalize your content