A heartbreaking story about time and money.

Berkonomics

OCTOBER 5, 2023

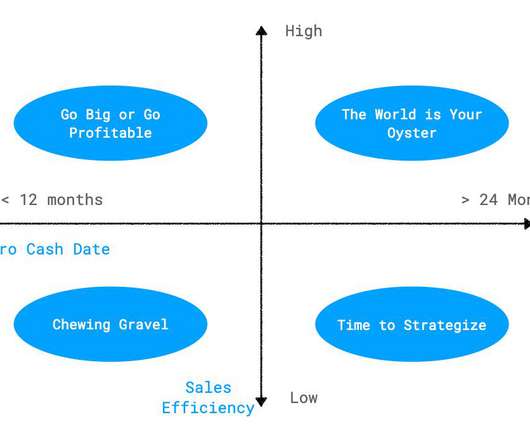

Since this number is budgeted and pre-authorized, managers tend to focus upon other things such as sales, marketing and product development issues. How about young or pre-revenue companies? And professional investors often penalize the company with lower-priced down rounds or expensive loans as a result.

Let's personalize your content