Investors Think They’re More Impactful Than They Actually Are

VC Adventure

JUNE 14, 2022

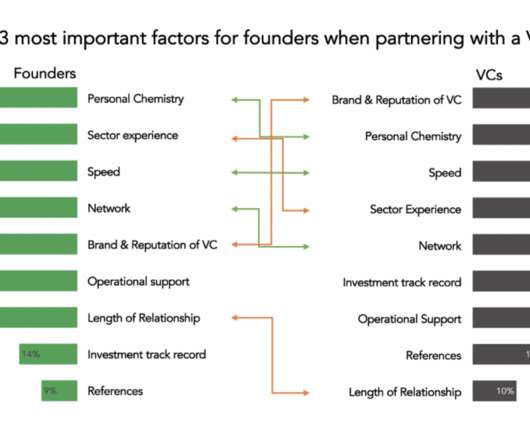

Companies looking to raise money turn to venture capital for a variety of reasons. Top among them is generally access to capital, but often on the list is the hope that raising capital from experienced (and well-networked) investors will have other positive impacts on their business.

Let's personalize your content