2021: The Version One year in review

Version One Ventures

DECEMBER 14, 2021

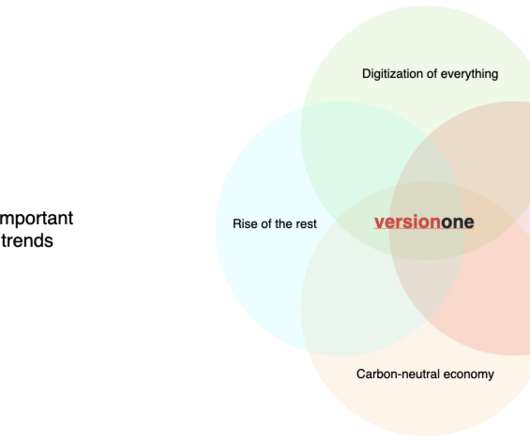

2021 might be remembered as the year the world started to fully embrace the opportunity that the technology sector has to offer… . Round sizes increased significantly across all stages, as did valuations. The incredible pace of the start-up market in 2021 is also reflected in the Version One portfolio: .

Let's personalize your content