Marketing and Growth Lessons for Uncertain Times

ConversionXL

MARCH 19, 2020

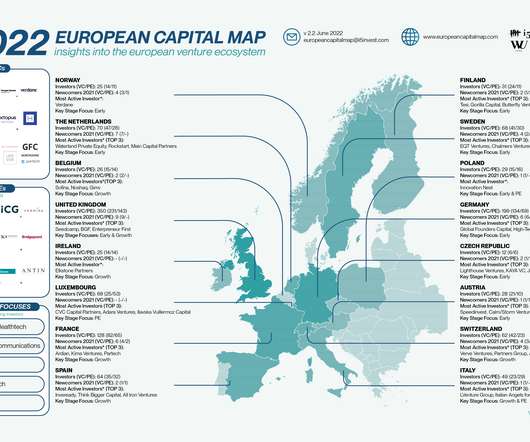

“Rare is the business that has a formal disaster plan, let alone one that covers a global Black Swan event.” An article on growth and marketing in the middle of a crisis—the current one or any other—can seem tone deaf. Bain offers a rubric based on your current market position and financial strength: ( Image source ).

Let's personalize your content