Consistent Revenue Growth At Core Of Google’s Mobile Advertising Strategy: TBR

YoungUpstarts

JANUARY 30, 2015

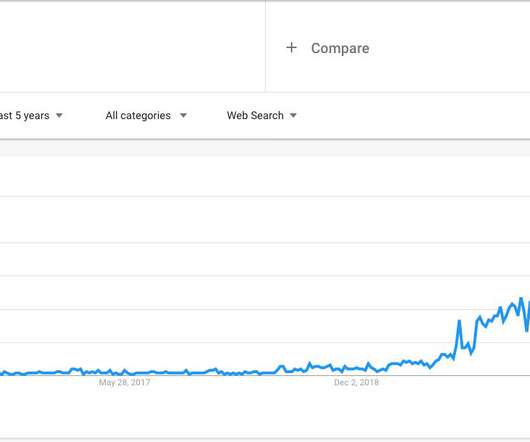

Google is focused on expanding its already broad reach into the advertising market by increasing the span and coverage of its digital and mobile platforms, and the company’s 4Q14 results highlight how the company’s efforts to buttress its core services is paying off: Google’s revenue and gross profit climbed 15.3% billion and generated $4.1

Let's personalize your content