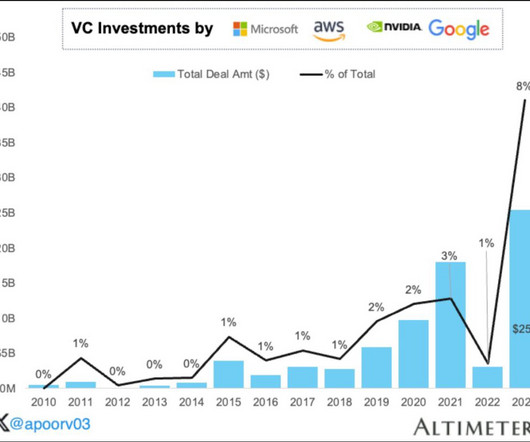

2023 Global Venture Reports were Gloomy, but there are reasons to be optimistic

VC Cafe

JANUARY 29, 2024

It’s easy to find bad news about venture capital these days. In other words, the venture capital bust has only just started. 2023 was a rough year for Venture Capital and for startups, and it might get even worse. Global venture funding fell 42% year over years to $248.8

Let's personalize your content