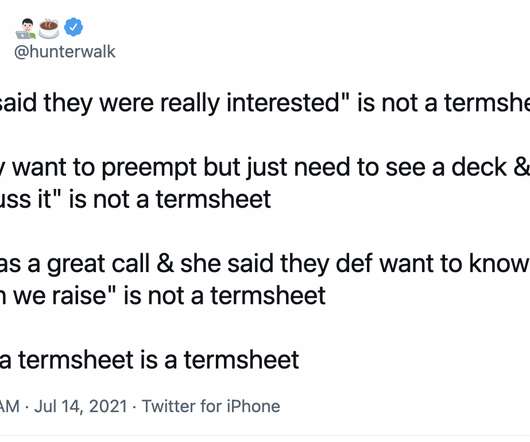

“I Can Really See Us Leading This Funding Round” Isn’t a Term Sheet

Hunter Walker

AUGUST 7, 2021

That’s not to say we’re always correct, but I will specifically tell a founder ‘and now I’m putting on my Homebrew hat’ when I have a POV that’s informed by my own needs as their capital partner versus what I generally think should be the company’s strategy. and include the major terms like Keith suggests. When it’s a junior partner.

Let's personalize your content