Top Hat Raises $22.5M Series C in a Tough Vertical: What Can We Learn from their Success

Version One Ventures

FEBRUARY 15, 2017

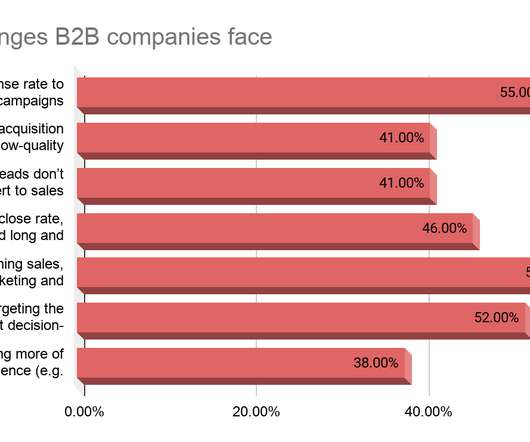

Generally speaking, Ed Tech has proven to be a tough vertical, primarily due to the fact that it’s hard to charge consumers (students) directly. And selling to institutions requires a long sales cycle. As such, Top Hat can provide key lessons for early-stage companies: 1. They focused on revenue early on.

Let's personalize your content