2021 was a record breaking year for Israeli startups. What now?

VC Cafe

JANUARY 14, 2022

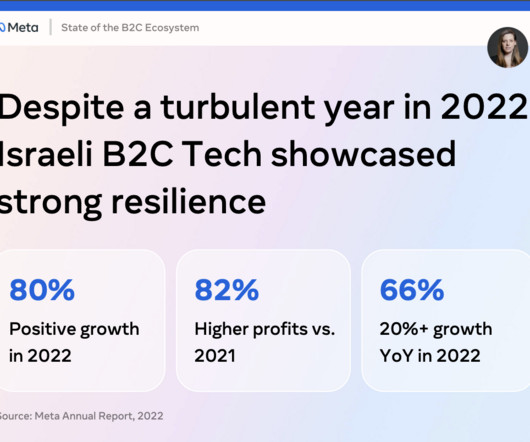

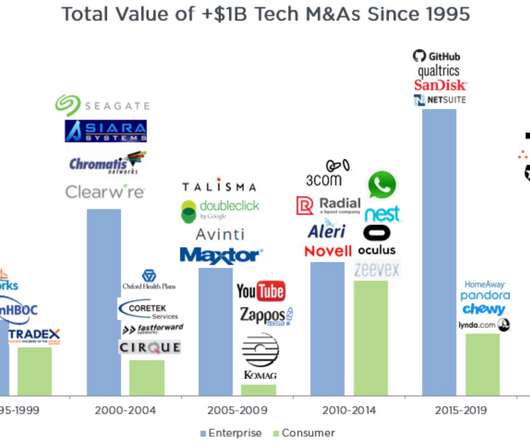

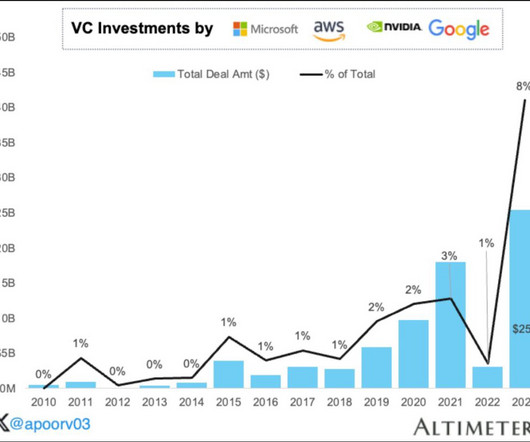

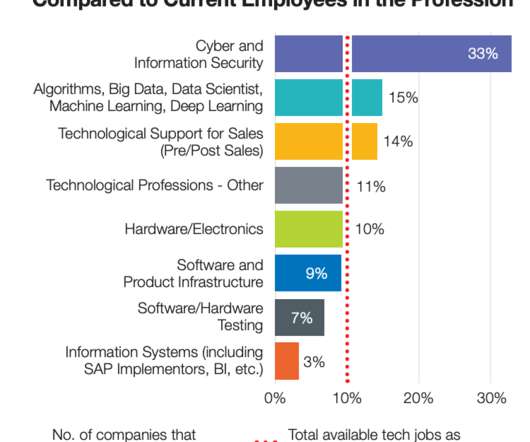

2021 Tech Trends: Israel is winning the global race for tech funding. Israel: $25.4 Shortage of talent – Israel is a country of 9 million people, and according to a recent report by the Israel Innovation Authority, only about 334,000, about 9.8% Israeli tech investments 2015-2021 (source: IVC ). US: $330 billion ??China:

Let's personalize your content