Conversion, retention and churn benchmarks

VC Cafe

FEBRUARY 21, 2023

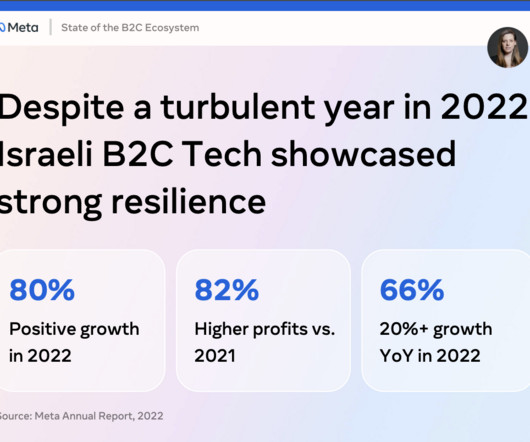

In a contracted venture capital environment, where external funding is more difficult to raise, founders know that they need to make due with less, and extend the runway further. For example, in B2B SaaS conversion, OpenView Partners 2022 benchmark report found that the average conversion rate for B2B SaaS businesses was 7.3%

Let's personalize your content