Visual Merchandising: Online Startups Cannot Afford to OverlookVisual Merchandising: Online Startups Cannot Afford to Overlook

ReadWriteStart

JANUARY 10, 2020

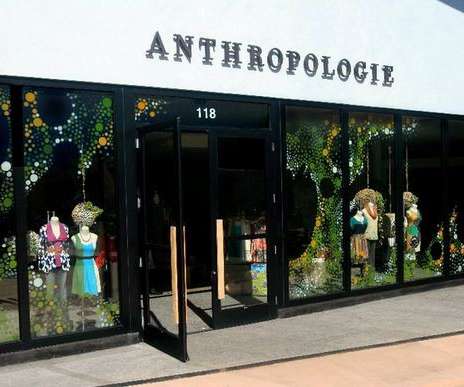

remains the core medium to draw customers and increase revenue. However, smaller brands can also deliver such an exquisite experience directly to customers, B2B, B2C, and even to non-fashion brands. Build customer relations and keep adding new stocks to inventory. Small brands can take this factor into account.

Let's personalize your content