Security Measures All Startups Should Take

The Startup Magazine

APRIL 29, 2018

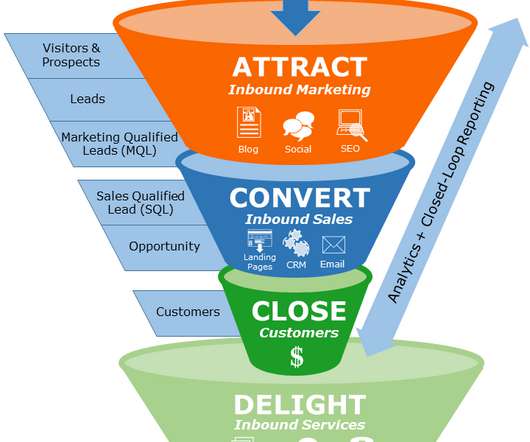

So things like security are often put on the back burner. Although progress and profit are certainly paramount, it’s imperative to protect your achievements by utilizing various forms of security to facilitate protection and redundancy across all forms of business. 1. IT Security. 4. Cash Flow Security.

Let's personalize your content