Why Has Seed Investing Declined? And What Does this Mean for the Future?

Both Sides of the Table

FEBRUARY 12, 2019

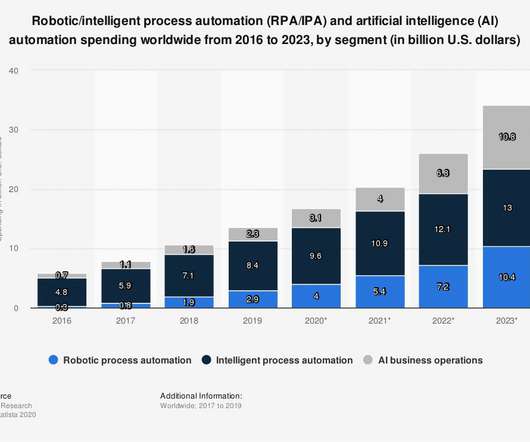

Round sizes of > $100 million or more now account for 47% of all VC dollars (62% if you count rounds > $50 million) This has made venture capital significantly more valuable for VCs and LPs who invest in the best companies As part of our study we noticed a trend many have spotted but few have explained?

Let's personalize your content