Airbnb S-1 (Part 1): So How Profitable Is This Thing Really?

View from Seed

NOVEMBER 18, 2020

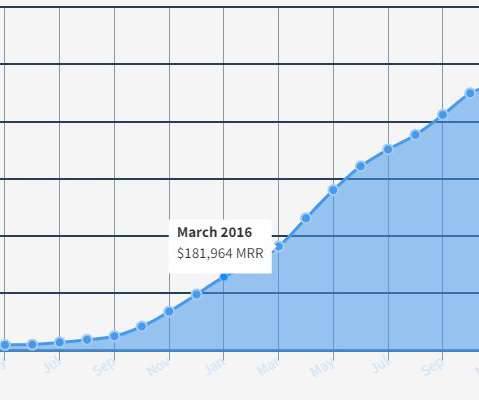

You can read various articles out there which will give you the cursory facts about Airbnb like their overall revenue or profitability or how their business has faired here in 2020 in the COVID environment. But even with this profitable Q3, on a trailing twelve months (TTM) basis Airbnb has a GAAP net loss of >$1 billion.

Let's personalize your content