What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

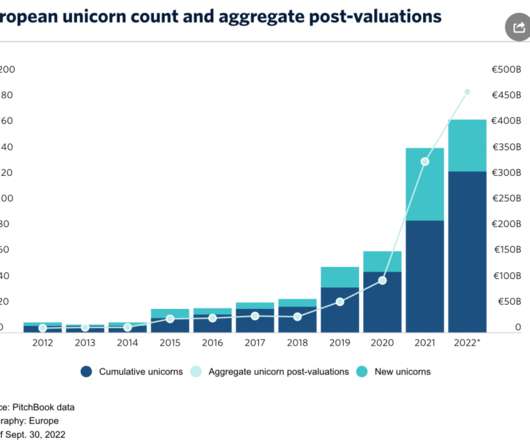

Should SaaS companies trade at a 24x Enterprise Value (EV) to Next Twelve Month (NTM) Revenue multiple as they did in November 2021? Median valuations for early-stage valuations tripled from around $20m pre-money valuations to $60m with plenty of deals being prices above $100m. What is a VC To Do?

Let's personalize your content