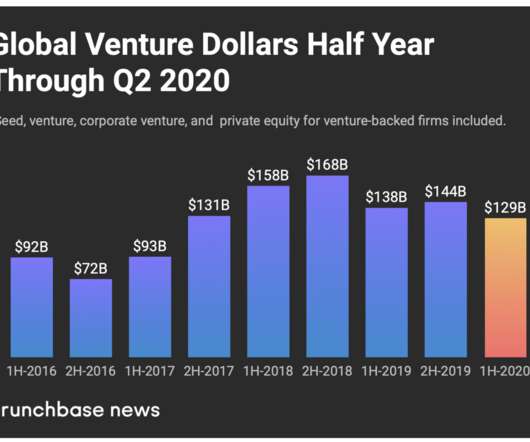

VC Funding in 2020: What Investors Look for in Startups

ReadWriteStart

MARCH 31, 2020

Venture capital investment is one of the top places startups look out for when seeking funding for their business alongside other popular options like angel investing and crowdfunding. Besides, such companies are incentivized by the government in different ways, including tax cuts. Stricter Business Conditions.

Let's personalize your content