What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

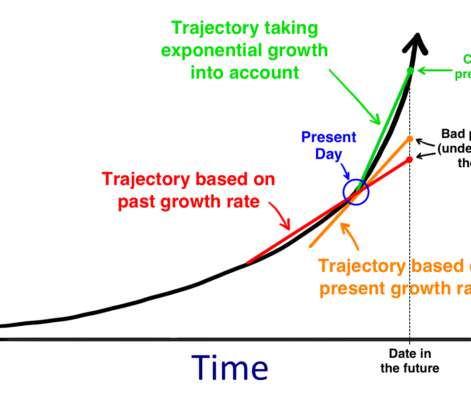

We drew this conclusion after a meeting we had with Morgan Stanley where they showed us historical 15 & 20 year valuation trends and we all discussed what we thought this meant. But rest assured valuations get reset. First in late-stage tech companies and then it will filter back to Growth and then A and ultimately Seed Rounds.

Let's personalize your content