Version One’s Year 2023 in Review

Version One Ventures

DECEMBER 28, 2023

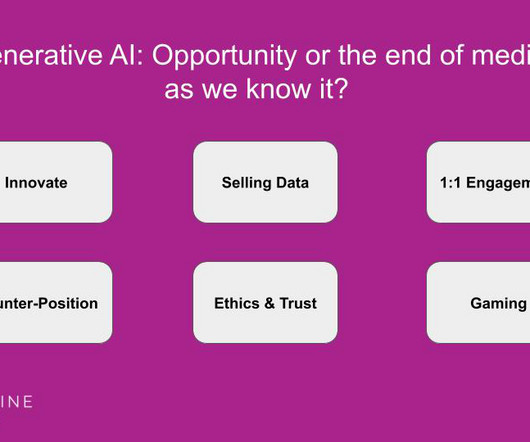

Boris wrote about how the most powerful disruptions occur when a technology disruption and a business model disruption go hand in hand … first the Internet, then the cloud, crypto and now AI. And thank you to our LPs, peers, partners, entrepreneurs, friends, followers, and our families for their support!

Let's personalize your content