Technology, Innovation, and Great Power Competition – 2022 Wrap Up

Steve Blank

JANUARY 5, 2023

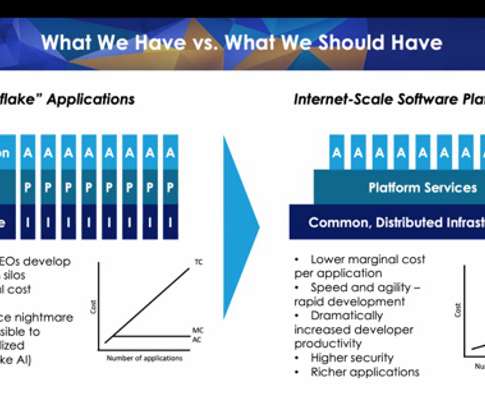

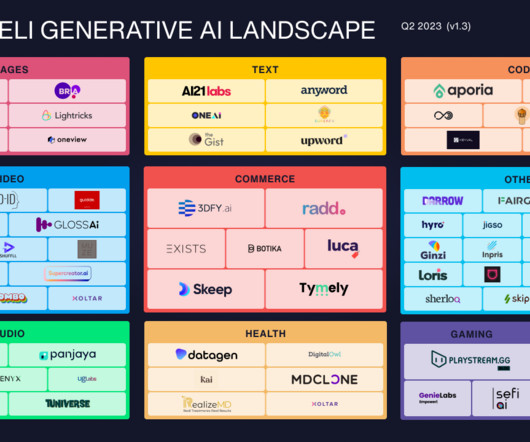

We just wrapped up the second year of our Technology, Innovation, and Great Power Competition class – now part of our Stanford Gordian Knot Center for National Security Innovation. government agencies, our federal research labs, and government contractors no longer have exclusive access to these advanced technologies.

Let's personalize your content