Build Predictable Startup Models by Forming an Agency

ReadWriteStart

DECEMBER 15, 2022

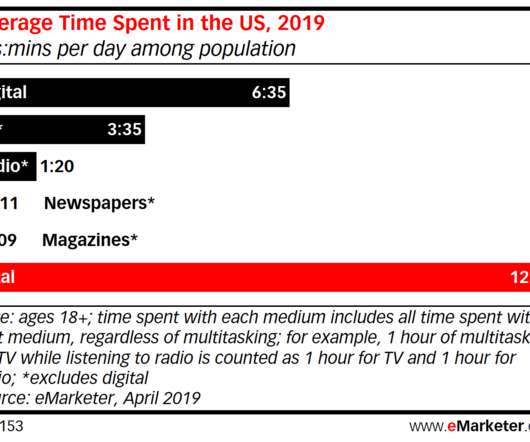

This could be by using a mobile app, interactive website, or some other digital platform. Over time, this revenue reduces the dependency on outside venture capital sources. Consider Agile or one of its variants for a flexible approach to building top-shelf mobile apps or interactive websites.

Let's personalize your content