Confronting A Radically New B2B Marketplace: The Storytelling Secret That Will Rock Your Result

YoungUpstarts

JANUARY 3, 2019

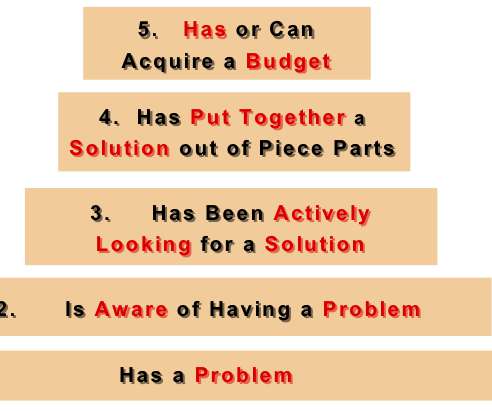

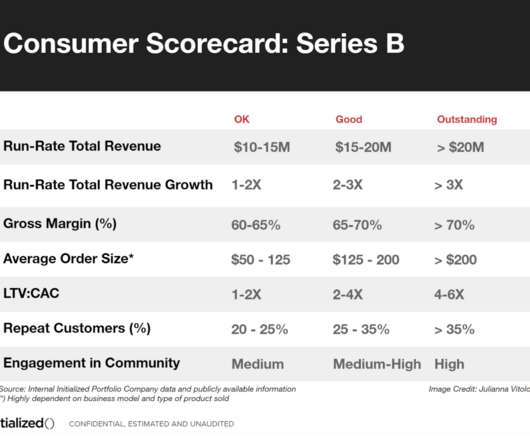

The challenge for marketing and sales professionals in business-to-business markets is breaking through the cacophony of noise and clutter to not only capture buyers’ attention, but powerfully communicate your unique value. Assessing value is not as simple as you think, and many B2B companies get this wrong.

Let's personalize your content