How to Build a Beloved Product Without Email Marketing

ConversionXL

APRIL 28, 2021

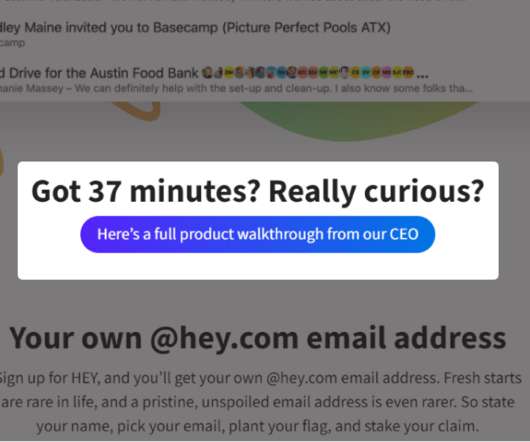

We stopped requiring users to provide an email address upon signing up—which ultimately meant that we ditched our email marketing efforts altogether. In the time since we decided to stop our email marketing, our business has grown exponentially. If I’m being honest, our user base was growing rapidly with email marketing.

Let's personalize your content