Lean Startups aren't Cheap Startups

Steve Blank

NOVEMBER 2, 2009

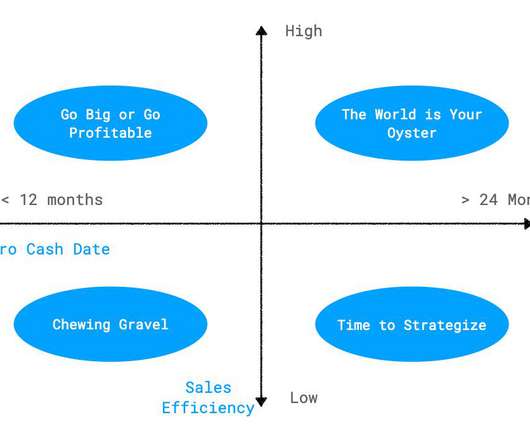

In times when venture capital is hard to get, investors extract high costs for failure (down-rounds, cram downs , new management teams, shut down the company.) Sales people cost money, and when they’re not bringing in revenue, their wandering in the woods is time consuming, cash-draining and demoralizing.

Let's personalize your content