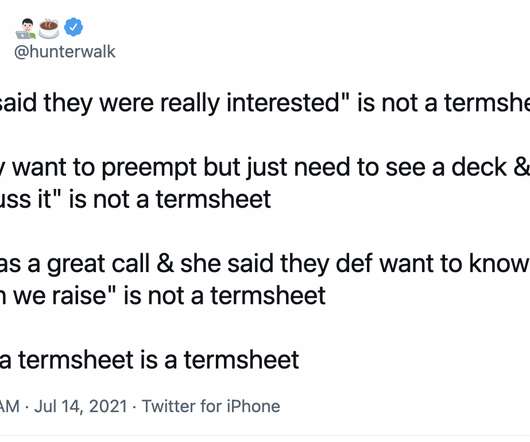

Founders. Run. Amok. It Starts With a Term Sheet.

This is going to be BIG.

MAY 27, 2014

Last week, for just the second time ever, I passed on an investment opportunity because of the terms of the deal--both the price and the legal structure of the agreement. The Term Sheet. They got that way due in large part to a very public founder friendly stance. Perhaps we all should. I certainly have. Rules like respect.

Let's personalize your content