The most important 2021 Predictions in entertainment tech and gaming

VC Cafe

JANUARY 24, 2021

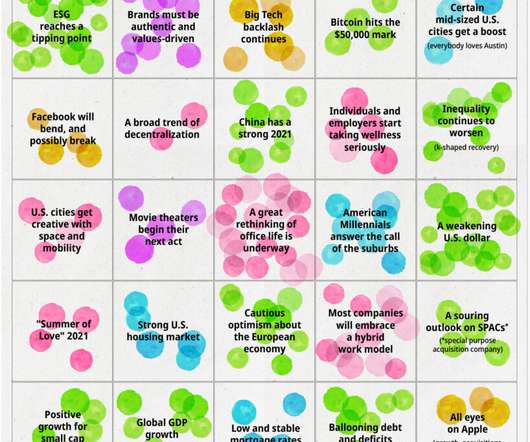

“It follows that the goal of forecasting is not to see what’s coming. It is to advance the interests of the forecaster and the forecaster’s tribe.” As a fan of prediction lists, I collected a number of interesting reports and expert forecasts for 2021 in the spaces we cover at Remagine Ventures.

Let's personalize your content