What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

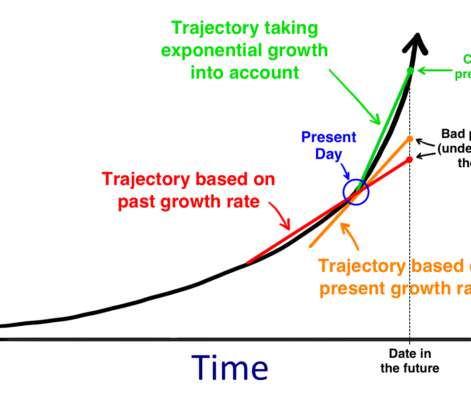

When you look at how much median valuations were driven up in the past 5 years alone it’s bananas. Median valuations for early-stage valuations tripled from around $20m pre-money valuations to $60m with plenty of deals being prices above $100m.

Let's personalize your content