State of VC 2.0

View from Seed

SEPTEMBER 14, 2021

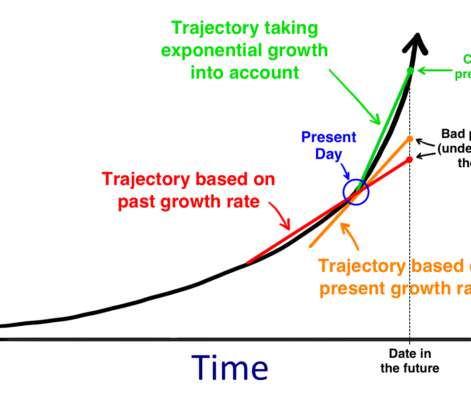

Both early- and late-stage startup valuations are currently elevated. For context, seed-stage pre-money valuations are up 24% from H1 2020 to H1 2021. Early-stage valuations are up 70%, and late-stage valuations are up 103% (source Pitchbook ). Source: Cambridge Associates.

Let's personalize your content