2023 Global Venture Reports were Gloomy, but there are reasons to be optimistic

VC Cafe

JANUARY 29, 2024

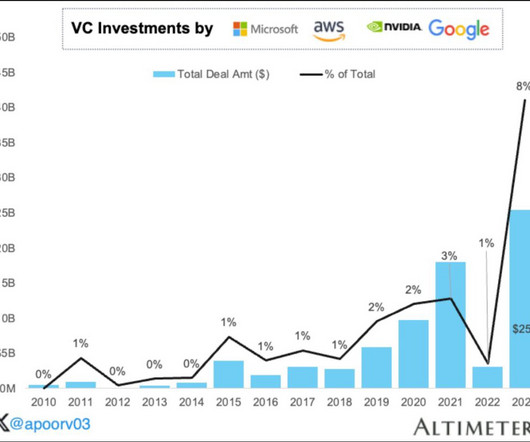

Global venture funding fell 42% year over years to $248.8 For example, Tiger Global, a crossover fund which was one of the most active venture investors in 2021 went from 194 deals in 2021 to a mere 20 in 2023 and has been trying to actively sell its positions in the secondary market at steep discounts to get liquidity.

Let's personalize your content