SEC Fines and Libra Woes

thebarefootvc

OCTOBER 3, 2019

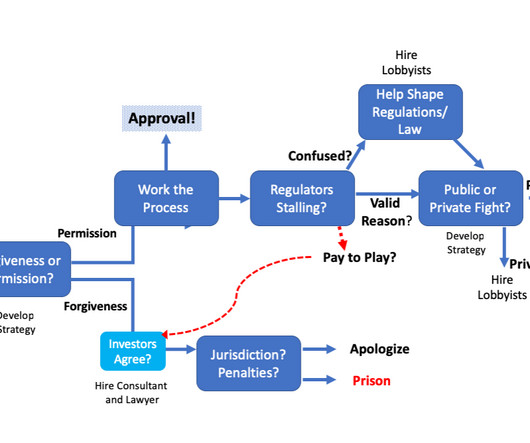

This past week, two companies within the token ecosystem announced settlements with the SEC. The SEC has been pursuing enforcement action for the past couple of years in wake of the ICO boom and bust of 2017. The post SEC Fines and Libra Woes appeared first on The Barefoot VC.

Let's personalize your content