5 Keys To Minimizing The Burn Rate For Your Startup

Startup Professionals Musings

SEPTEMBER 29, 2018

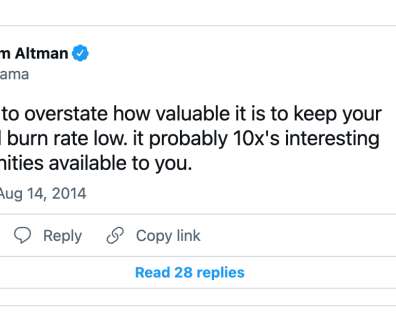

Investors check your burn rate to assess your efficiency, and project your remaining runway before you run out of money and into a brick wall. It doesn’t take a financial genius to recognize that you need to keep your burn rate low. Cash flow out equates to burn rate, and the runway depends on your reserves.

Let's personalize your content