10 Rosh Hashanah Resolutions for Startup Founders

VC Cafe

SEPTEMBER 26, 2022

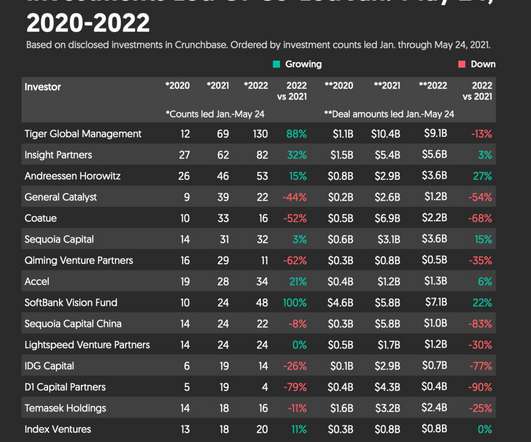

Many startups that raised money in 2021 on inflated valuations that were detached from their actual value, are struggling to raise up-rounds and face difficult choices these days: down rounds, early sellout or failing altogether. A good way to think about valuation in seed/pre-seed is to reverse engineer the next round.

Let's personalize your content