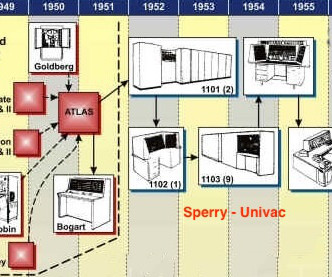

The Secret History of Minnesota Part 1: Engineering Research Associates

Steve Blank

DECEMBER 11, 2023

The story starts with a company you probably never heard of – Engineering Research Associates. While it seemed like a good idea and had the Navy’s backing, the founders got turned down for funding by companies, investment bankers and everyone, until they talked to John Parker. Parker agreed to invest.

Let's personalize your content