Investing in Downturns

VC Adventure

APRIL 2, 2020

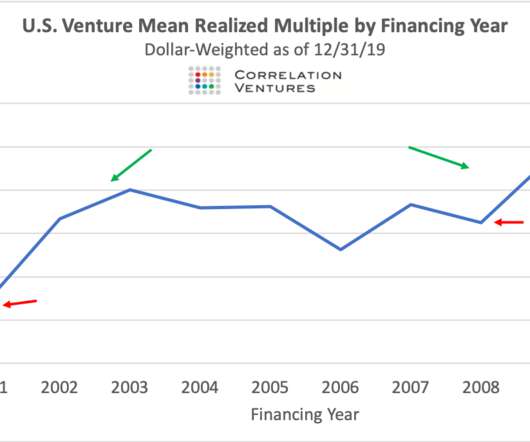

Everyone is being cautious about valuations. Anecdotally I’ve heard that early stage valuations are already down 30-50%. First, the overall trends, which show both a steady increase of returns post the 2000 bubble and show the specific increases post 9/11 and post the 2008 market crash. Obviously, better to invest after.

Let's personalize your content