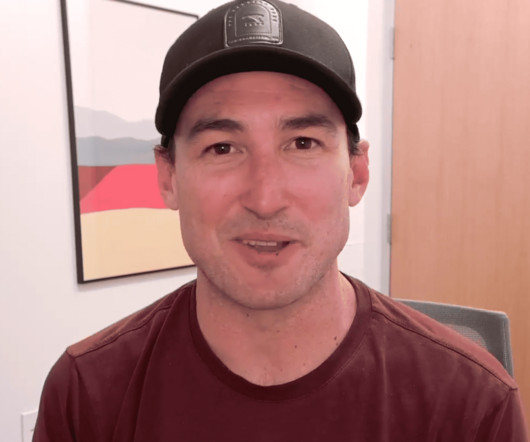

Brian Nichols, Angel Investor (Hustle Fund, Angel Squad), Lyft ‘Mafia’ Angel Syndicate, How To Pick Unicorns

Entrepreneurs-Journey.com by Yaro Starak

JULY 19, 2023

Brian Nichols in 2014 had an offer to work at Facebook, Twitter or Lyft. This was just one of the early startups he worked out, many of which turned into great experiences, but no big financial gains. He chose Lyft.

Let's personalize your content