5 Equity Distribution Parameters For Key Contributors

Startup Professionals Musings

MAY 1, 2023

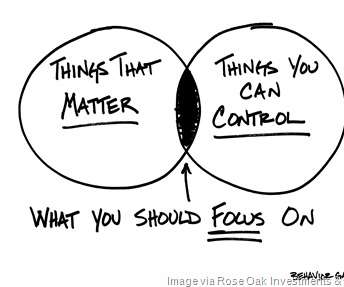

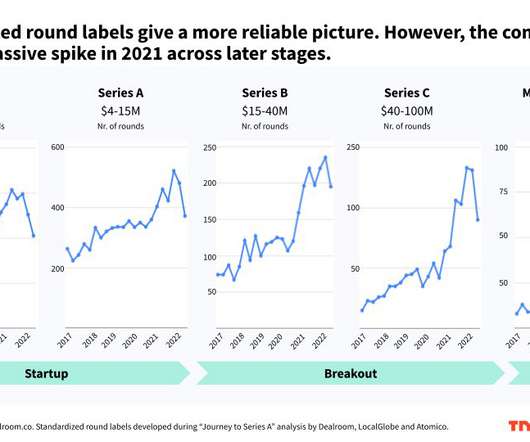

Of course, all cofounders need to remember that allocated percentages will be diluted as angel and VC investors are brought in. Keep your wits about you to make sure that dilution is done equitably and evenly. The CFO may have a major financial background, but might be a minority owner.

Let's personalize your content