In Q4 2022, founders face tough choices

VC Cafe

OCTOBER 31, 2022

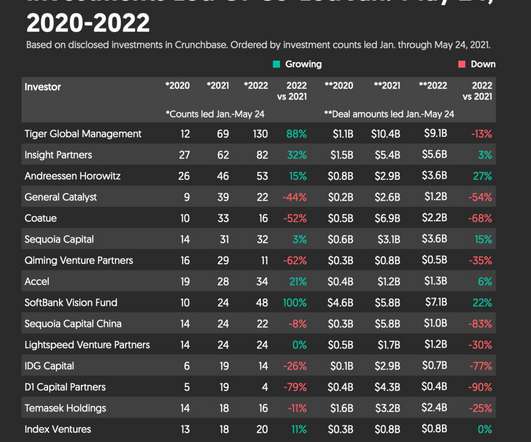

It’s a tough time for a lot of startup founders right now. Many companies are now having to resort to tough measures in order to stay afloat, including layoffs, down rounds and tough terms from current investors. The pressure to protect portfolio startups seen as potential fund returners will be profound.

Let's personalize your content