Introducing the Cap Table and Hiring the CTO

Feld Thoughts

SEPTEMBER 2, 2011

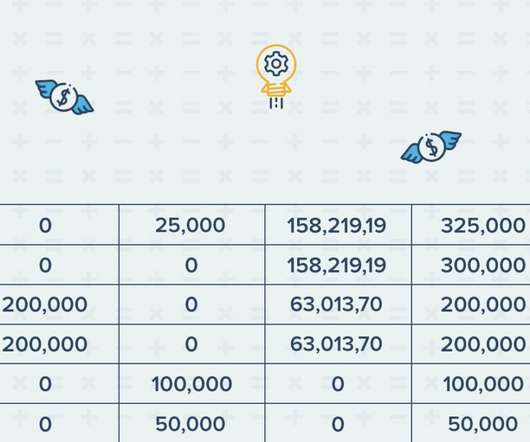

As Finance Fridays continues, we are introducing the concept of the Cap Table. This week they set out to create their cap table and hire a CTO. Rather, it gets recorded in a document called the Capitalization Table (or “Cap Table”), which shows the ownership stake each person or entity has in the business.

Let's personalize your content