The Due Diligence Hierarchy of Pain

View from Seed

MARCH 11, 2020

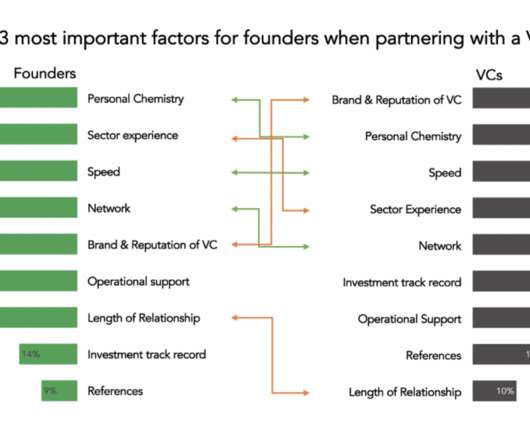

When a founder is raising money, he/she should expect that any serious investor will conduct some level of due diligence before getting to yes. More mature companies will have to answer more detailed questions around their tech, product, and business. This could look somewhat different depending on the maturity of the business.

Let's personalize your content