5 Equity Distribution Parameters For Key Contributors

Startup Professionals Musings

MAY 1, 2023

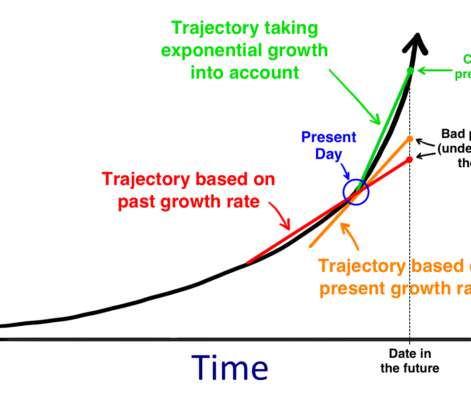

Investors may not be called cofounders, but they always get equity, commensurate with their share of the total costs anticipated, or share of the current valuation. Even with an agreed initial equity split, it’s smart to have Founder’s stock actually issue or vest over a period of at least two years, on a month-by-month basis.

Let's personalize your content