Technical Review: A Trusted Look Under the Hood

TechEmpower

AUGUST 21, 2023

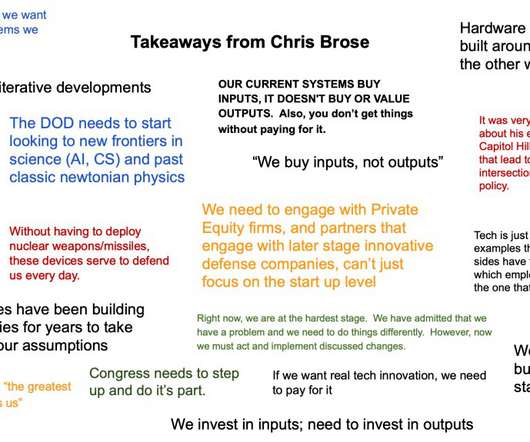

Most innovators don’t have a technical background, so it’s hard to evaluate the truth of the situation. And unless they have a tech background, they can’t look under the hood themselves. The answer is to engage a trusted outside source for a Technical Review – a deep-dive assessment that provides a C-suite perspective.

Let's personalize your content