6 New Venture Realities To Target Your Funding Effort

Startup Professionals Musings

JUNE 28, 2021

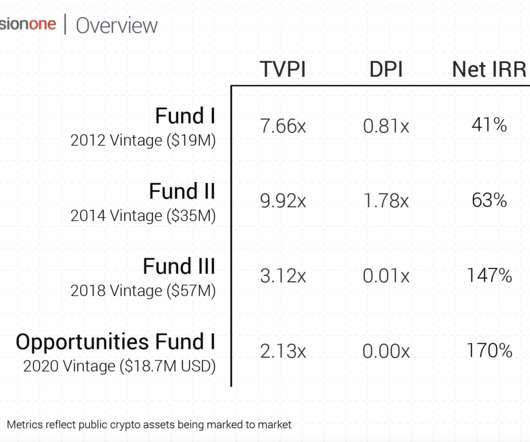

Nevertheless, according to Rose, both are poised for further growth due to online technology, and there is indeed plenty of opportunity. There is a rarified brand of successful investors who can show average IRRs of 25 percent or greater over the years. If you subscribe to truths one to five, startup investing can be lucrative.

Let's personalize your content