10 Rosh Hashanah Resolutions for Startup Founders

VC Cafe

SEPTEMBER 26, 2022

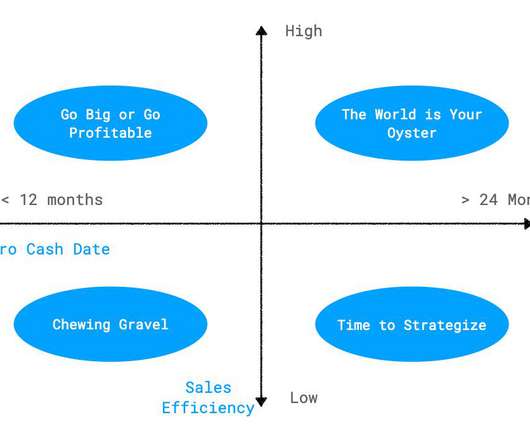

The past year was a wild ride for startups and founders, giving a whole new meaning to the ”rollercoaster” aspect of being an entrepreneur. Sustainable growth: Prioritise sales efficiency over growth at all costs. Patrick Collison , self-made billionaire founder of Stripe. Bill Gates , founder of Microsoft.

Let's personalize your content