Quick Thoughts on Term Sheets and LOIs

Rob Go

DECEMBER 14, 2016

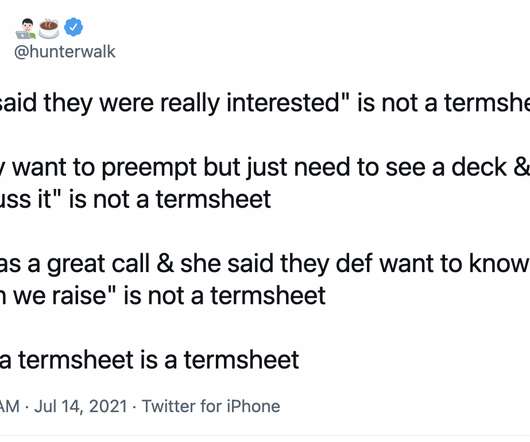

When a VC invests in a startup, the two parties usually sign a term sheet that lays out the major terms of the investment round. 90%+ of term sheets result in a closed deal that is more or less equivalent to what was discussed. In the M&A process, an LOI feels an awful lot like a term sheet.

Let's personalize your content