In Q4 2022, founders face tough choices

VC Cafe

OCTOBER 31, 2022

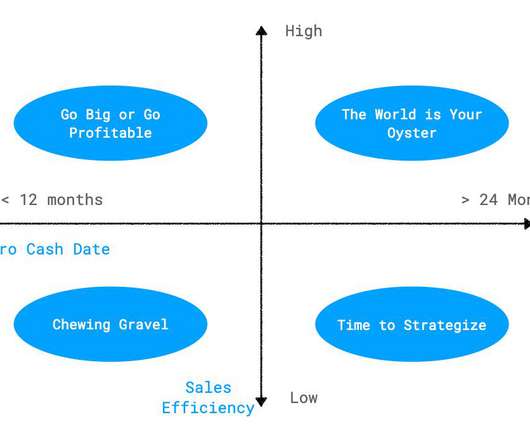

Many companies are now having to resort to tough measures in order to stay afloat, including layoffs, down rounds and tough terms from current investors. If the answer is yes, then a down round is likely the best path forward. Why you shouldn’t worry about raising a down round ( source ).

Let's personalize your content