The Magnificent Seven Invest $400 Billion a year in Frontier Technologies

VC Cafe

MAY 30, 2024

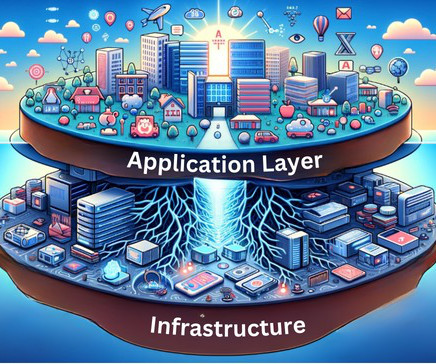

An interesting new report by Dealroom and Flow Partners breaks down the massive investment that the “Magnificent Seven” (or M7 for short) are plowing into AI across verticals. billion in VC deals, more than the UK venture investments per year combined. Technology head start – Nvidia, OpenAI and Anthropic ?

Let's personalize your content