5 Steps To Finding The Best Investor For Your Startup

Startup Professionals Musings

FEBRUARY 10, 2023

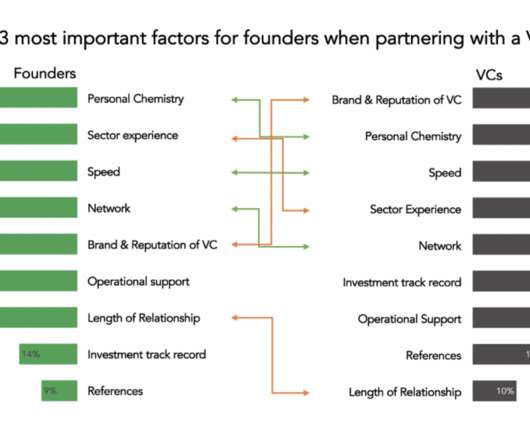

Struggling entrepreneurs are often so happy to get a funding offer that they neglect the recommended reverse due diligence on the investors. Investor due diligence on a startup is not a mysterious black art, but is nothing more than a final integrity check on all aspects of your business model, team, product, customers, and plan.

Let's personalize your content